HOME Financial Information Income Statement

Income Statement

POSCO Holdings IR information is available at the official website. POSCO Holdings

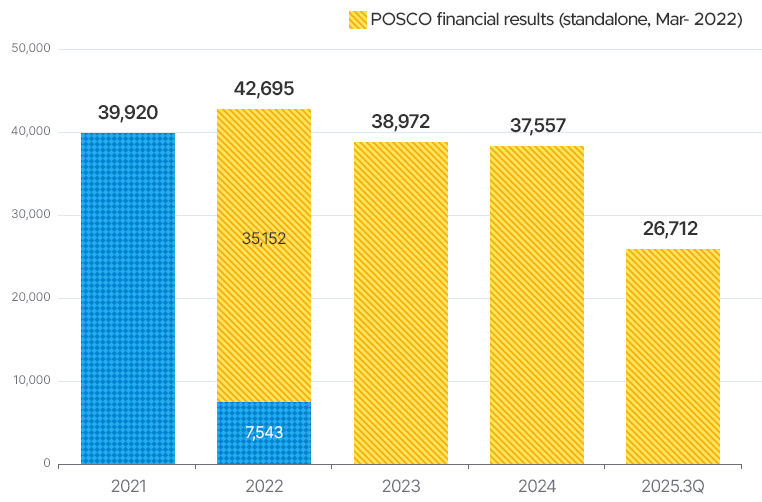

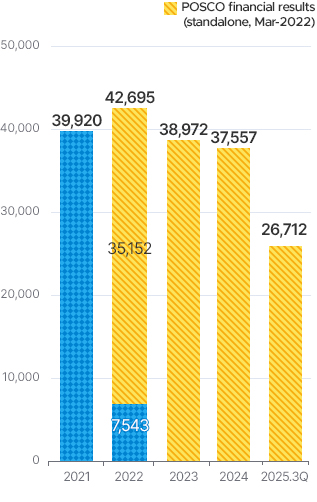

Revenue

(Seperated, Unit: KRW billion)

※ Figures for Jan. 2021-Feb. 2022 are POSCO’s standalone financials generated before the spin-off.

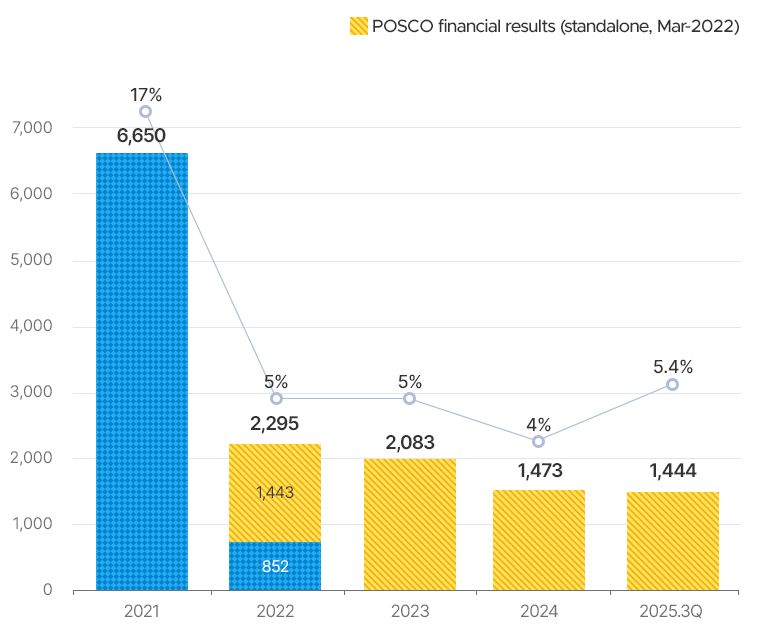

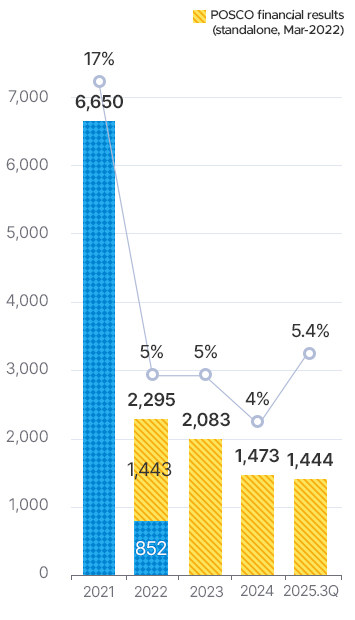

Operating profit

(operating margin)

/ (Seperated, Unit: KRW billion)

※ Figures for Jan. 2021-Feb. 2022 are POSCO’s standalone financials generated before the spin-off.

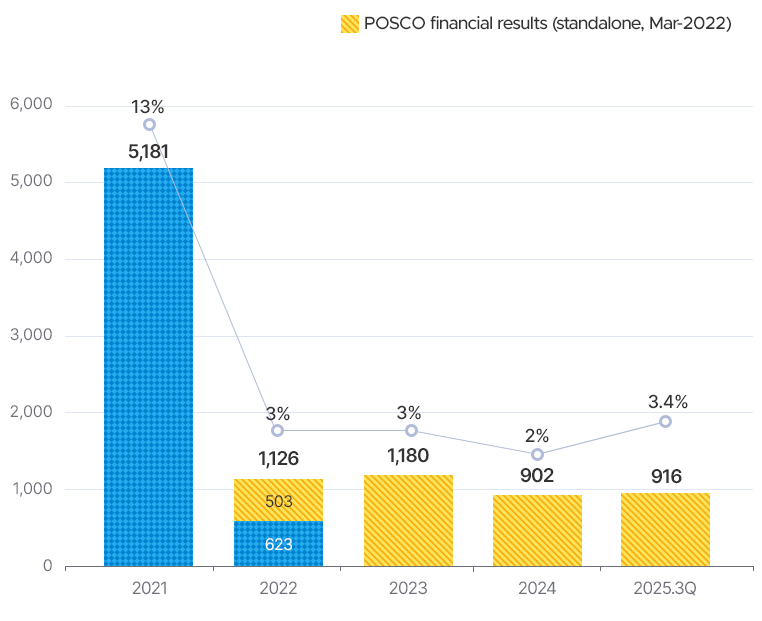

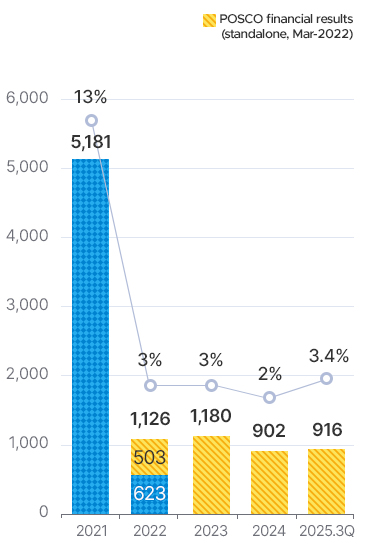

Net profit (net profit margin)

(Seperated, Unit: KRW billion)

※ Figures for Jan. 2021-Feb. 2022 are POSCO’s standalone financials generated before the spin-off.

(Seperated, Unit: KRW billion)

| Classification | 2021 | 2022 | 2023 | 2024 | 2025.3Q | ||

|---|---|---|---|---|---|---|---|

| Jan-Feb | Mar-Dec | ||||||

| Revenue | 39,920 | 42,695 | 7,543 | 35,152 | 38,972 | 37,557 | 26,712 |

| Gross profit | 7,784 | 3,503 | 1,073 | 2,429 | 3,282 | 2,657 | 2,321 |

| Operating profit | 6,650 | 2,295 | 852 | 1,443 | 2,083 | 1,473 | 1,444 |

| Net profit | 5,181 | 1,126 | 623 | 503 | 1,180 | 902 | 916 |

| EBITDA | 9,047 | 4,674 | 1,253 | 3,422 | 4,410 | 2,993 | 3,296 |

※ Figures for Jan. 2021-Feb. 2022 are POSCO’s standalone financials generated before the spin-off.